HOUSE INTELLIGENCE — PUBLIC OPERATOR REPORT

# 48–96 Hour Action Window

Date: January 9, 2026 Coverage: Inland + Port-Adjacent U.S. Terminals Prepared by: Hampson Strategies — House Intelligence (NPVIS)

⸻

EXECUTIVE ACTION SIGNAL

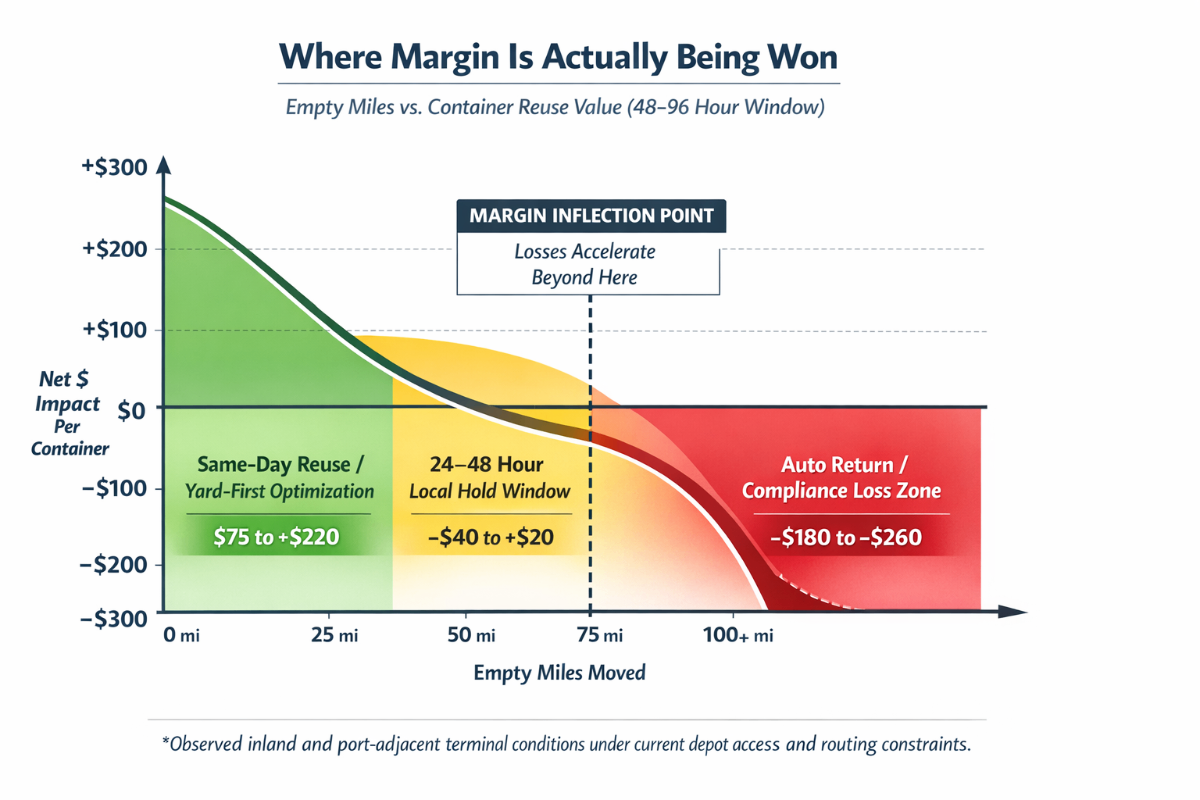

Over the next 48–96 hours, terminals and fleets that delay empty returns and prioritize local reuse will outperform by $75–$220 per container move relative to baseline contracts.

- Depot access friction

- Rail-in / truck-out imbalance

- Insurance-driven routing latency

- Mispriced empty reposition miles

⸻

SYSTEM STATUS (NOW)

Observed Conditions - Empty containers accumulating inland of ports - Import boxes dwelling 24–72 hrs longer at DCs and processors - Rail ramps releasing containers faster than depots can absorb - Drayage fleets absorbing unpriced empty miles as "operational noise"

Interpretation This is not congestion — this is misaligned container ownership timing.

⸻

ACTIONABLE OPPORTUNITY #1 — STREET TURNS

Probability: HIGH Execution Difficulty: LOW Time Sensitivity: IMMEDIATE

What to Do - Hold empties locally for 24–48 hrs instead of auto-routing to depots - Offer same-day turn availability to nearby exporters, reloaders, and shippers - Prioritize consignee-to-shipper handoffs over depot returns

Why It Works - Depot appointment scarcity inflates empty reposition miles - Local shippers are already asking for equipment — quietly - Every avoided empty return saves 40–120 deadhead miles

Operator Metric

If an empty moves more than 35 miles without revenue, the turn was missed.

⸻

ACTIONABLE OPPORTUNITY #2 — RAIL RELEASE TIMING

What to Watch (Next 72 hrs) - Rail ramps accelerating unload windows - Chassis availability briefly improving before tightening again

What to Do - Pull imports early in the window - Pair rail pickups with pre-identified reload candidates - Avoid overnight dwell that forces depot routing the next morning

Why It Works

Rail velocity is temporarily outrunning depot throughput. This creates short-lived container availability pockets.

⸻

ACTIONABLE OPPORTUNITY #3 — INSURANCE-DRIVEN ROUTING

Probability: MEDIUM Execution Difficulty: LOW

What to Do - Expect longer transit ETAs baked into new bookings - Do not over-rotate on "late" arrivals — they are system-wide - Focus on post-arrival utilization, not arrival precision

Why It Works

Insurance clauses are reshaping routes faster than pricing models. Operators who assume "normalization" will over-position assets.

⸻

DO NOT DO THIS (COMMON LOSSES)

❌ Auto-return empties "to stay compliant" ❌ Chase depot appointments at any cost ❌ Assume next week's volumes solve this ❌ Treat empties as neutral moves

Each of these locks in guaranteed margin leakage.

⸻

HOUSE INTELLIGENCE BENCHMARK

- Reducing empty miles by 18–32%

- Increasing same-day container reuse

- Running yard-first intelligence, not port-first

- Treating empties as revenue candidates, not liabilities

⸻

WHAT THIS REPORT IS

✔ One-time public release ✔ Immediately executable ✔ Terminal-level intelligence ✔ No software required

WHAT IT IS NOT

✘ Marketing ✘ Forecasting ✘ Theory ✘ Generic analytics

⸻

This report is already being generated privately for select terminals.

- Your terminal added

- Your yard mapped

- Your empty exposure quantified

- Your street-turn potential surfaced

Reach out directly.

We already know where to look.

— Hampson Strategies House Intelligence | NPVIS | Terminal & Yard Optimization

⸻