Scope

This morning's observations are based on a continuation of the same structural scans used at Friday's close, supplemented by pre-market futures context, intraday structure, and relative price positioning across multiple timeframes. The scans focus on: • relative implied volatility behavior, • price quietness versus time, • compression and mean-reversion geometry, • and cross-instrument recurrence, using only publicly available market data. No forecasts, trade recommendations, or directional conclusions are drawn.

What Changed

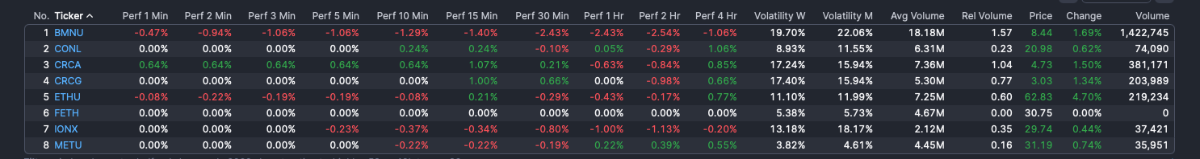

Following Friday's close, price remained largely orderly, both overnight and into the early cash session, while structural pressure persisted. Across the names that repeatedly surfaced: • spot prices are modestly green or flat, • short-term micro returns show early give-back and absorption, • and price continues to gravitate toward short-term and intermediate anchors rather than extending. On an intraday basis, several instruments attempted continuation higher, but failed to accelerate, resolving instead through time and controlled mean reversion. Volume remains present but non-urgent, consistent with participation rather than liquidation. At the macro proxy level, futures and ETF structures did not resolve the underlying tension. Overnight movement was muted, and early cash participation has not displaced prior compression.

What Did Not Change

• No earnings proximity for the names listed below. No single macro headline or discrete catalyst explaining the behavior. No broad, disorderly breakdown in major indices at the time of observation.

Names That Stood Out

The following names repeatedly surfaced near the top of the scan based on volatility lift, price quietness, and compression context: • IFRX — Elevated option activity relative to muted price movement. • HESM — Quiet price behavior alongside rising implied volatility. • DXD — Inverse equity exposure showing increased insurance demand. • TZUP — Duration-sensitive hedge vehicle with persistent optionality interest. • TTT — Inverse long-duration Treasury exposure with volatility lift. • TWM — Inverse small-cap equity exposure surfacing in multiple passes. • EPV — Inverse European equity exposure appearing alongside U.S. hedges. • NVDS — Single-name inverse exposure showing elevated optionality. • SMG — Non-inverse, real-economy-adjacent name surfacing alongside hedge instruments. These names span leveraged exposures, crypto-adjacent vehicles, and small-cap or alternative structures. Their recurrence is notable not because of direction, but because similar behavior is appearing across unrelated products.

Boundaries

This entry documents observed market structure and capital behavior as of the December 26, 2025 pre-open. It does not: • predict price direction or timing, • recommend trades or positions, • imply sustainability or intent. Short-term watch items (days-weeks): • Whether liquidity persists following initial volatility release • Signs of stall or reinforcement in thin-depth structures Mid-term considerations (1-6 months): • Transition from dispersed volatility expression to index-level resolution • Evolution of liquidity depth and dealer positioning dynamics Long-term structural factors (6-24 months): • Capital flow patterns from AI and energy tech investments reshaping operational risk profiles • Cost transparency evolution in AI infrastructure deployment This is a personal log of market observations based on publicly available information. It is not investment advice, nor does it suggest any specific trading strategy or position. No action is suggested or implied.

This is a personal log of market observations based on publicly available data. It is not investment advice, a recommendation, or a prediction. No action is suggested or implied.