Scope

This 10:15 scan reflects a continuation of the same structural filters active at the open, incorporating early cash-session behavior, intraday compression dynamics, and cross-instrument recurrence. The observations are derived from: • relative implied volatility behavior, • time-based compression versus price displacement, • convex / coiling phase classification, • liquidity-weighted recurrence across unrelated instruments, using only publicly observable market data. No forecasts, trade recommendations, or directional conclusions are drawn.

What Changed

Between the open and the 10:15 window, price activity has progressed primarily through time, not range. Several instruments that surfaced pre-market or at the open attempted minor continuation moves, but those moves did not extend. Instead, they resolved through time and controlled mean reversion. Volume remains present but non-urgent, consistent with participation rather than liquidation. There was no acceleration in realized volatility to match the persistence of structural compression observed earlier. At the index and ETF level, broad proxies remained contained. Intraday oscillations did not materially alter the underlying geometry established overnight and at the open.

What Did Not Change

• No earnings events or company-specific news driving the behavior. • No macro headline producing coordinated movement across assets. • No volatility shock, forced unwind, or disorderly liquidity event. • No sector-wide narrative driving the observations. Despite the transition from the opening rotation into mid-morning trade, the same structural features continue to recur. The passage of time has not displaced the compression; it has reinforced it.

Names That Stood Out

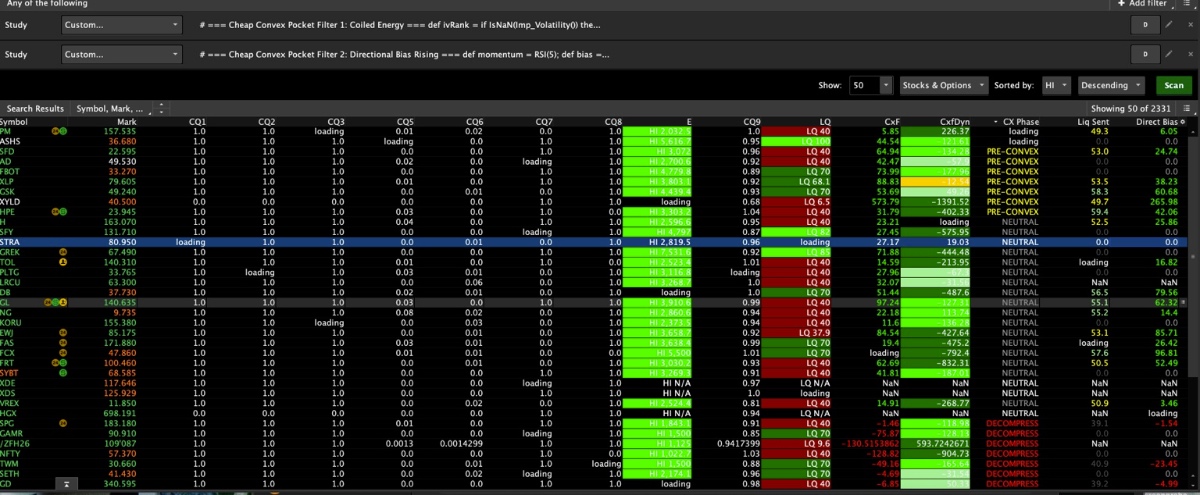

The following instruments continued to surface across multiple scans at 10:15 due to shared characteristics of compression, liquidity, and phase alignment, rather than directional behavior: • ASH • DB • HPE • PLTG • SPY / XLP / XLY • IWM The recurrence across unrelated sectors and vehicles remains notable. The commonality is structural, not thematic.

Boundaries

Bottom Line This is not a market poised for immediate collapse — it is a market quietly redistributing risk into places that do not handle stress gracefully. Calm here is not safety. It is stored pressure. When release comes, it will not ask permission.

This is a personal log of market observations based on publicly available data. It is not investment advice, a recommendation, or a prediction. No action is suggested or implied.